There’s an ongoing discussion over on Linkedin around online or offline PIN for US issuers. The conversation has drifted over floor limits and contactless as well.

I think zero floor limits in the UK date back to the time that UK acquirers introduced an 0800 phone number for POS authorisations. At that point the cost of the phone call, 10p at the time, was being absorbed by the acquirer. With no call costs to the merchant, it made sense to reduce floor limits towards zero. Clearly the reduced fraud and chargebacks makes a strong business case to even the smallest merchant. After a segway of some 10 or more years, it’s interesting to see online PIN making it’s way back into the APACS standards. But I digress.

With the cost of communications for authoristation near zero (toll free or internet), zero floor limit is pretty much the norm (except in the Nordic countries). With Debit cards, issuers are pretty risk averse, and will set their CRM to be online most of the time. With Credit cards I’m seeing issuers allow some offline transactions in the issuing currency, and forced online when “foreign”.

PERFORMANCE MEETS PRECISION. The grippers of the WSG series combine lightweight construction with long service life and precision. The heart of the gripping modules is a brushless precision drive with an enormous power density. » EMV-Compliant Credit Card Processing. To protect yourself from liability for fraudulent credit card transactions, use a system with EMV (Europay, Mastercard, Visa) “chip” card processing. It’s the most secure and up-to-date payment technology. Franchises are all about expansion.

On both sides of the transaction, there’s a strong move, even in countries where EMV is fully rolled out towards 100% authorisation. It’s not about the CVM – it’s about the risk.

Deploying online PIN with appropriate key management to POS devices is expensive, with key loading, HSMs, and so on. Some countries don’t have a history of online PIN, like the UK. Other countries only have online PIN for debit. Others still have a history of online PIN for all cards – some even with 6 digit PINs.

Both Visa and MasterCard have minimum recommendations for attended POS devices, that they should support offline PIN and signature CVMs. Online PIN is optional. (Yes, Maestro has other requirements – not for here).

The main reason to introduce PIN at POS is to simplify the verification of the cardholder. Supermarket checkout operators were never really interested if your mag-stripe card was (a) signed or (b) the scrawl on the receipt was anyway accurate – they were looking towards the end of their shift.

Automated validation of the cardholder is quicker, has less chance of an error, and when the PIN is correctly protected by the cardholder (i.e. not written down), it’s very secure. Biometrics would also work in this space.

From the cardholder side, offline PIN or online PIN – it’s the same. It has the same protection. The same outcome, and with near 100% authorisation, it takes about the same length of time to complete the transaction. In fact, I prefer that cardholders don’t know that there are two PINs, one on the card, and one on the host.

It’s an issuer choice, do they prefer online PIN to have preference over offline PIN if the device supports online PIN. If so, and they understand what it means for their cardholders and where they transact most, then OK, great do that. If the majority of transactions takes place in Finland (for example, where online PIN is not supported), then offline PIN should be the preferred CVM. One issuer (who shall remain nameless) introduced a card into a market that supported online PIN, with a CVM entry “online PIN if in application currency”, followed by offline PIN if supported, then online PIN if supported, and then signature. It covered all the bases for their cardholders.

And that’s it – it’s an informed issuer choice, who is able to best decide the risk for their cardholders. On the acceptance side, it’s nice to support online PIN at POS if you can, but if not, offline PIN is also possible.

Description

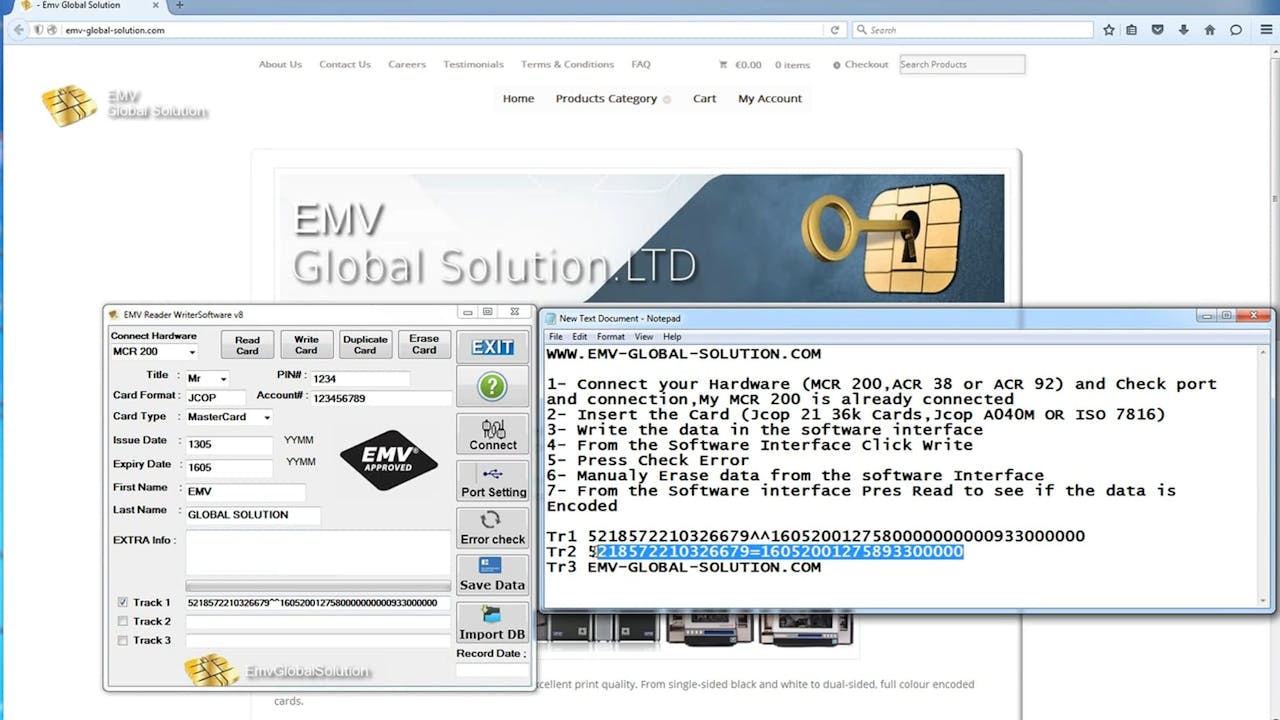

EMV Reader Writer Software v8.6 How to install

1-) Extract the Rar archive On Your Desktop

2-)Open the EMV Reader Writer Software v8.6 Folder.

3-)Inside This Folder you have The EMV Reader Writer Software v8.6 Setup file,Your Unique License Key and Your Unique HWID,Run the EMV Reader Writer Software v8.6.exe as admin (Very Important for the License Key to Auto Install and for your HWID to Lond you need to run the setup in the Folder as ADMIN,allow the software 5 Min until is install,once the installation is done you will see a popup showing you your license key and your HWID.

Emv Software As

4-)Once is done you need to install your Unique PFX file,inside your Folder you will see a file called ‘EMV Reader Writer Software v8.6_Key’ open it and click next

Once a gain click Next.

Then a New window will ask you for your Unique Certificate Password ‘Enter the Unique Password that you receive via e-mail.

Once is done Click Next

Now Click Finish.

Once is done you will get.

Emv Software Cracked Download

5-)Open your EMV Reader Writer Software v8.6 The shortcut Is on your Desktop.

EMV Reader Writer Software v8.6 How to Read

EMV Reader Writer Software v8.6 How to Use